Revisiting Stylized Facts for Modern Stock Markets

December 2023 by Ethan Ratliff-Crain, Colin M. Van Oort, James Bagrow, Matthew T. K. Koehler, Brian F. Tivnan

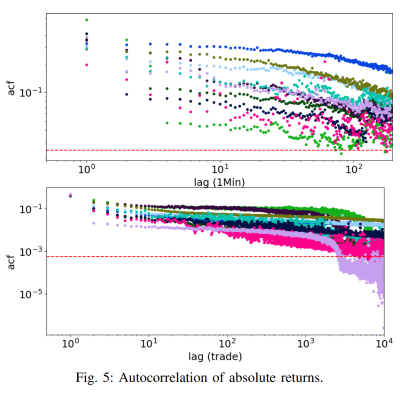

Figure 5 from publication. Autocorrelation of absolute returns for 10 stocks of interest in clock time and trade-time, click the image for more information.

In 2001, Rama Cont introduced a now-widely used set of ‘stylized facts’ to synthesize empirical studies of financial time series, resulting in 11 qualitative properties presumed to be universal to all financial markets. Here, we replicate Cont’s analyses for a convenience sample of stocks drawn from the U.S. stock market following a fundamental shift in market regulation. Our study relies on the same authoritative data as that used by the U.S. regulator. We find conclusive evidence in the modern market for eight of Cont’s original facts, while we find weak support for one additional fact and no support for the remaining two. Our study represents the first test of the original set of 11 stylized facts against a consistent set of stocks, therefore providing insight into how Cont’s stylized facts should be viewed in the context of modern stock markets.

Adaptive Agents and Data Quality in Agent-Based Financial Markets

November 2023 by Colin M. Van Oort, Ethan Ratliff-Crain, Brian F. Tivnan, Safwan Wshah

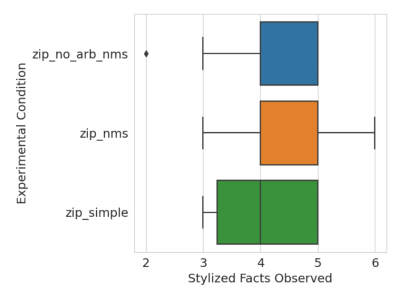

Figure 3 from publication. Replication of stylized facts across different simulation configurations, click the image for details.

We present our Agent-Based Market Microstructure Simulation (ABMMS), an Agent-Based Financial Market (ABFM) that captures much of the complexity present in the US National Market System for equities (NMS). Agent-Based models are a natural choice for understanding financial markets. Financial markets feature a constrained action space that should simplify model creation, produce a wealth of data that should aid model validation, and a successful ABFM could strongly impact system design and policy development processes. Despite these advantages, ABFMs have largely remained an academic novelty. We hypothesize that two factors limit the usefulness of ABFMs. First, many ABFMs fail to capture relevant microstructure mechanisms, leading to differences in the mechanics of trading. Second, the simple agents that commonly populate ABFMs do not display the breadth of behaviors observed in human traders or the trading systems that they create. We investigate these issues through the development of ABMMS, which features a fragmented market structure, communication infrastructure with propagation delays, realistic auction mechanisms, and more. As a baseline, we populate ABMMS with simple trading agents and investigate properties of the generated data. We then compare the baseline with experimental conditions that explore the impacts of market topology or meta-reinforcement learning agents. The combination of detailed market mechanisms and adaptive agents leads to models whose generated data more accurately reproduce stylized facts observed in actual markets. These improvements increase the utility of ABFMs as tools to inform design and policy decisions.

Ecological and Coevolutionary Dynamics in Modern Markets Yield Nonstaionarity in Market Efficiencies

June 2022 by Colin M. Van Oort, John H. Ring IV, David Rushing Dewhurst, Christopher M. Danforth, Brian F. Tivnan

Figure 1 from publication. Connects infrastructure changes to volatility, click the image for details.

The U.S. stock market is one of the largest and most complex marketplaces in the global financial system. Over the past several decades, this market has evolved at multiple structural and temporal scales. New exchanges became active, and others stopped trading, regulations have been introduced and adapted, and technological innovations have pushed the pace of trading activity to blistering speeds. These developments have supported the growth of a rich machine-trading ecology that leads to qualitative differences in trading behavior at human and machine time scales. We conduct a longitudinal analysis of comprehensive market data to quantify nonstationary dynamics throughout this system. We quantify the relationship between fluctuations in the number of active trading venues and realized opportunity costs experienced by market participants. We find that information asymmetries, in the form of quote dislocations, predict market-wide volatility indicators. Lastly, we uncover multiple micro-to-macro level pathways, including those exhibiting evidence of self-organized criticality.

Fragmentation and Inefficiencies in the U.S. Equity Markets: Evidence from the Dow 30

February 2019 by Brian F. Tivnan, David Rushing Dewhurst, Colin M. Van Oort, John H. Ring IV, Tyler J. Gray, Brendan F. Tivnan, Matthew T. K. Koehler, Matthew T. McMahon, David Slater, Jason Veneman, Christopher M. Danforth

Figure 8 from publication. Dislocation segments in AAPL across the 2016 calendar year, click the image for more information.

Using the most comprehensive source of commercially available data on the US National Market System, we analyze all quotes and trades associated with Dow 30 stocks in 2016 from the vantage point of a single and fixed frame of reference. Contrary to prevailing academic and popular opinion, we find that inefficiencies created in part by the fragmentation of the equity market place are widespread and potentially generate substantial profit for agents with superior market access. Information feeds reported different prices for the same equity, violating the commonly-supposed economic behavior of a unified price for an indistinguishable product more than 120 million times, with “actionable” dislocation segments totaling almost 64 million. During this period, roughly 22% of all trades occurred while the SIP and aggregated direct feeds were dislocated. The current market configuration resulted in a realized opportunity cost totaling over $160 million when compared with a single feed, single exchange alternative a conservative estimate that does not take into account intra-day offsetting events.

Scaling of inefficiencies in the U.S. equity markets: Evidence from three market indices and more than 2900 securities

February 2019 by David Rushing Dewhurst, Colin M. Van Oort, John H. Ring IV, Tyler J. Gray, Christopher M. Danforth, Brian F. Tivnan

Figure 3 from publication. Dislocation segments in GALE from July 2016 to June 2017, click the image for more information.

Using the most comprehensive, commercially-available dataset of trading activity in U.S. equity markets, we catalog and analyze dislocation segments and realized opportunity costs(ROC) incurred by market participants. We find that dislocation segments are common, observing a total of over 3.1 billion dislocation segments in the Russell 3000 during trading in 2016, or roughly 525 per second of trading. Up to 23% of observed trades may have contributed the the measured inefficiencies, leading to a ROC greater than $2 billion USD. A subset of the constituents of the S&P 500 index experience the greatest amount of ROC and may drive inefficiencies in other stocks. In addition, we identify fine structure and self-similarity in the intra-day distribution of dislocation segment start times. These results point to universal underlying market mechanisms arising from the physical structure of the U.S. National Market System.

An agent-based model for financial vulnerability

July 2018 by Richard Bookstaber, Mark Paddrik, and Brian Tivnan.

Figure 2 from publication. The plumbing of critical components of the financial system. Click image for more information.

This study addresses a critical regulatory shortfall by developing a platform to extend stress testing from a microprudential approach to a dynamic, macroprudential approach. This paper describes the ensuing agent-based model for analyzing the vulnerability of the financial system to asset- and funding-based fire sales. The model captures the dynamic interactions of agents in the financial system extending from the suppliers of funding through the intermediation and transformation functions of the bank/dealers to the financial institutions that use the funds to trade in the asset markets. The model replicates the key finding that it is the reaction to initial losses, rather than the losses themselves, that determine the extent of a crisis. By building on a detailed mapping of the transformations and dynamics of the financial system, the agent-based model provides an avenue toward risk management that can illuminate the pathways for the propagation of key crisis dynamics such as fire sales and funding runs.

Toward an understanding of market resilience: market liquidity and heterogeneity in the investor decision cycle

October 2016 by Richard Bookstaber, Michael Foley, and Brian Tivnan.

Panel b from figure 3 of publication. Order density plots (click image for more information).

During liquidity shocks such as occur when margin calls force the liquidation of leveraged positions, there is a widening disparity between the reaction speed of the liquidity demanders and the liquidity providers. Those who are forced to sell typically must take action within the span of a day, while those who are providing liquidity do not face similar urgency. Indeed, the flurry of activity and increased volatility of prices during the liquidity shocks might actually reduce the speed with which many liquidity providers come to the market. To analyze these dynamics, we build upon previous agent-based models of financial markets, and specifically the Preis et. al (Europhys Lett 75(3):510–516, 2006) model, to develop an order-book model with heterogeneity in trader decision cycles. The model demonstrates an adherence to important stylized facts such as a leptokurtic distribution of returns, decay of autocorrelations over moderate to long time lags, and clustering volatility. Consistent with empirical analysis of recent market events, we demonstrate the impact of heterogeneous decision cycles on market resilience and the stochastic properties of market prices.

Abrupt rise of new machine ecology beyond human response time

September 11, 2013 by Neil Johnson, Guannan Zhao, Eric Hunsader, Hong Qi, Nicholas Johnson, Jing Meng, and Brian Tivnan.

Figure 1 in publication. A depiction of Ultrafast Extreme Events (UEEs), click image for more details.

Society's techno-social systems are becoming ever faster and more computer-orientated. However, far from simply generating faster versions of existing behaviour, we show that this speed-up can generate a new behavioural regime as humans lose the ability to intervene in real time. Analyzing millisecond-scale data for the world's largest and most powerful techno-social system, the global financial market, we uncover an abrupt transition to a new all-machine phase characterized by large numbers of subsecond extreme events. The proliferation of these subsecond events shows an intriguing correlation with the onset of the system-wide financial collapse in 2008. Our findings are consistent with an emerging ecology of competitive machines featuring ‘crowds’ of predatory algorithms, and highlight the need for a new scientific theory of subsecond financial phenomena.

Affiliated Organizations

Copyright ©2025 The MITRE Corporation and the University of Vermont. All rights reserved. Approved for public release. Distribution unlimited 18-03431-3.

This work is licensed under a

Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

This work is licensed under a

Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.